Total volume of Champagne shipments declined by 1.8% in 2018 to 301.9 million bottles, with a total turnover reaching €4.9 billion – 0.3% higher than in 2017.

As reported by the Comité Champagne at Prowein today, exports of Champagne are on an upward trajectory, rising by 0.6% in volume and 1.8% in revenue.

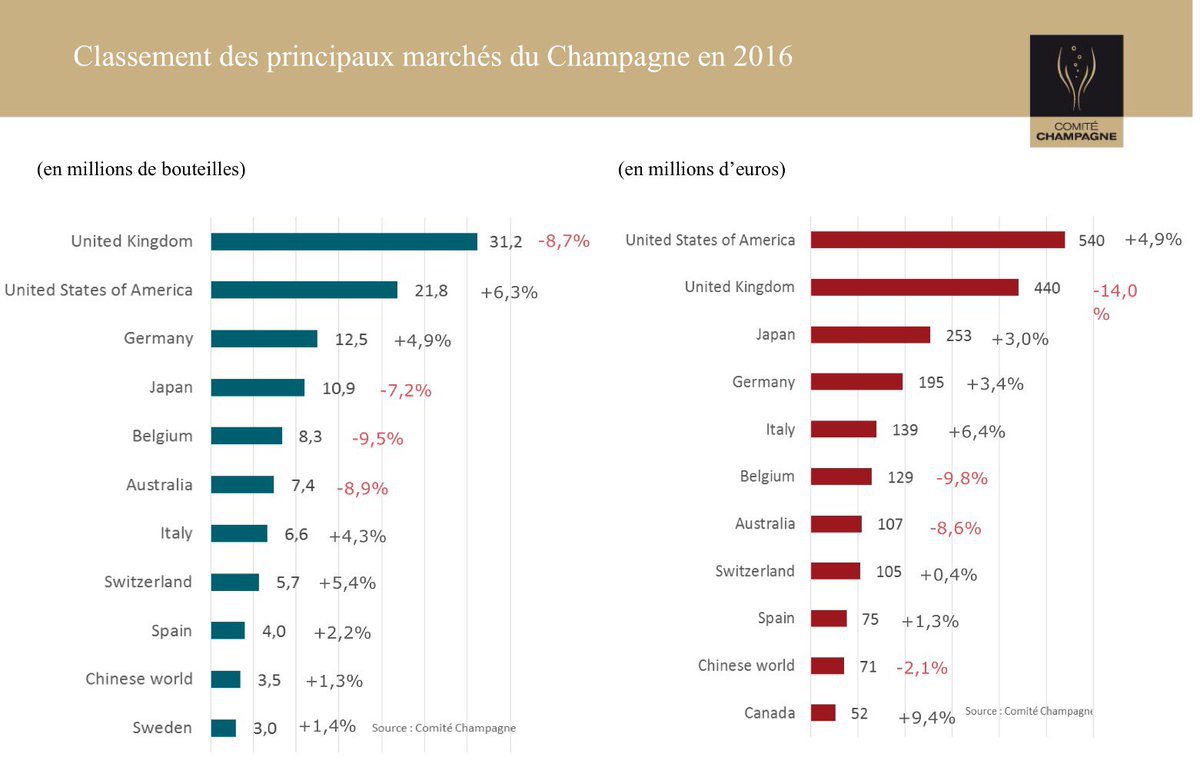

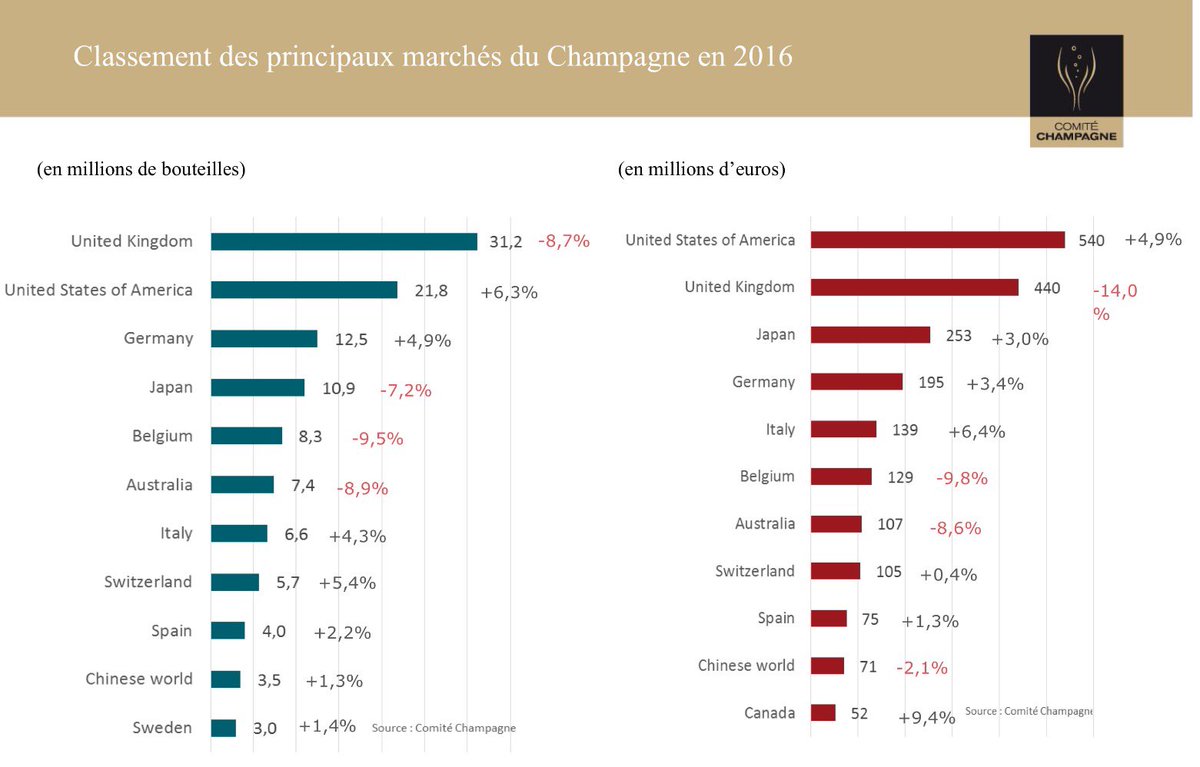

In Champagne’s more traditional markets of France and the UK, which together account for 60% of total sales, volumes dropped by around 4% each, while by value turnover slipped by around 2% in both markets.

The UK market, which remains the largest export market by volume, imported 26.7m bottles in 2018, a decline of 3.6%, while value reached €406.2m, a drop of 2.2% – making it the second biggest export market by value after the USA.

However, demand is most dynamic beyond the European Union. The USA, which remains the biggest export market by value and second biggest by volume, saw exports rise by 2.7% to 23.7 million bottles. To Japan, exports increased by 5.5% to 13.6 million bottles, while exports to the “Chinese triangle” (mainland China, Hong Kong, and Taiwan) increased by 9.1% to 4.7 million bottles.

Following very significant growth over the past decade (+134%), Australia saw imports of Champagne dip slightly, by 1.8%, to 8.4m bottles, which was attributed to a “less favourable exchange rate”.

Other countries are emerging stronger for Champagne, including Canada which increased its imports by 4.8% to 2.3 million bottles, Mexico by 4.3% to 1.7m bottles, and South Africa, where sales topped the million-bottle mark for the very first time, recording growth of 38.4% by volume and by 43.4% by value – the highest increase of any market on both counts.

“The 2018 results validate the value creation strategy of the Champagne region, based on a continual pursuit of exceptional quality and rigorous environmental targets,” the Comité Champagne said. “From an agronomic point of view, 2018 was an unprecedented year with a bumper harvest of outstanding quality, boding extremely well for the future Champagne cuvées.”

Champagne shipments* over the past 10 years:

2018: 301.9m

2017: 307.3m

2016: 306.1m

2015: 313m

2014: 307m

2013: 305m

2012: 309m

2011: 323m

2010: 319m

2009: 293m

Source: Drinks Business and Just Drinks

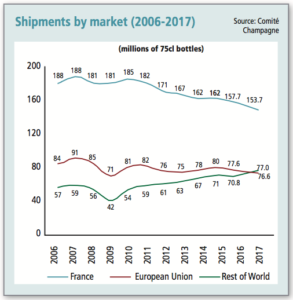

Estimated figures for total shipments during 2018 show that more Champagne was consumed in foreign markets than France for the first time in over 50 years.

Estimated figures for total shipments during 2018 show that more Champagne was consumed in foreign markets than France for the first time in over 50 years.